- Coinfeeds Daily Digest

- Posts

- Kraken's Altcoin Triumph, XRP Plays Trillionaire on Gemini!

Kraken's Altcoin Triumph, XRP Plays Trillionaire on Gemini!

Coinbase's Summery Layer-2 Fest, Visa eases crypto gas pains and Canada's lukewarm stance on digital finance

Welcome to Daily Digest, where we surface trending news in crypto-based on conversations we found on Twitter, news publications, blog posts, and other social media, powered by the Coinfeeds platform.

Here are the trending news items over the last 24 hours. If you’d like to see it’s realtime updated version, head over to our website here.

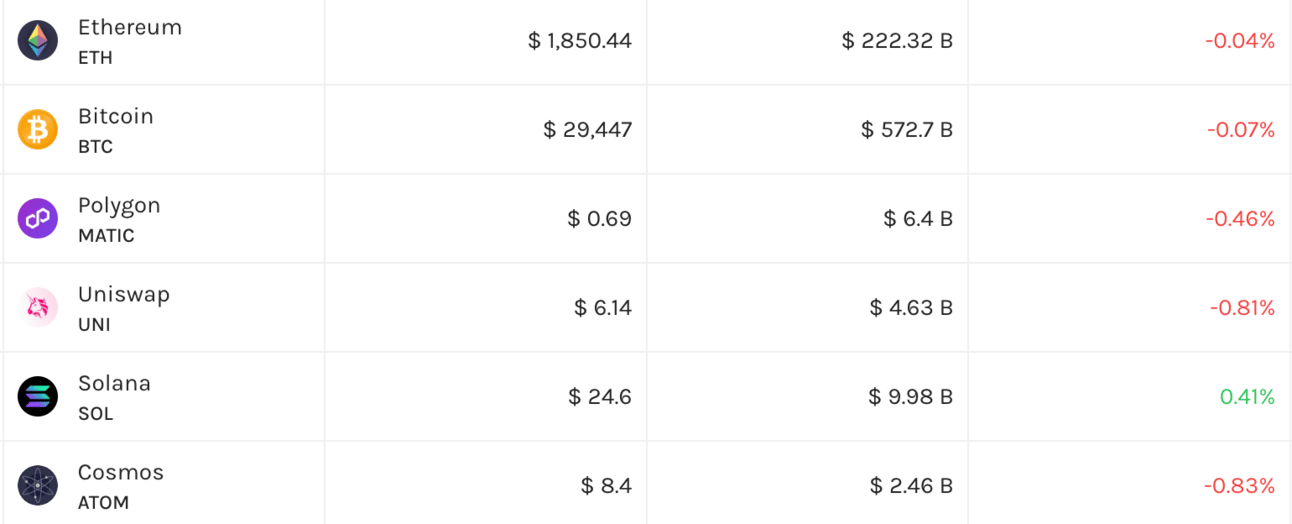

Market Updates

News

XRP's Temporary Spike on Gemini

XRP experienced a temporary surge on the Gemini crypto exchange, causing its market capitalization to briefly reach trillions of dollars. The spike in prices occurred due to low liquidity following a token relisting on Gemini, potentially caused by an outsized market order being filled at an extremely high price. Market observers speculate that a spoof order at $50 per XRP was unintentionally filled by a buyer. XRP liquidity on Gemini remains relatively low compared to other exchanges. The tokens were relisted on Gemini after a court ruling in favor of Ripple Labs, stating that the sale of XRP on digital asset exchanges did not constitute the sale of investment contracts.

Coinbase's Layer-2 Solution Attracts Huge Investments

Coinbase's new layer-2 scaling solution Base attracted hundreds of millions of dollars worth of Ethereum (ETH) and other crypto assets just hours after its launch. The data shows that $163 million has been moved to the bridge, including 72,724 ETH, $19.2 million worth of USDC, $5.7 million worth of DAI, and $3.1 million worth of cbETH. Base's daily transactions reached over 380,000 on its public launch day, and the number of daily active users rose to 100,983. Coinbase is celebrating the launch with an on-chain summer festival.

Kraken Surpasses Coinbase in Altcoin Trading

Kraken has emerged as the leading US crypto exchange for altcoin trading, surpassing Coinbase, according to data from Kaiko. Kraken commands 47% of the market depth for the top 10 altcoins and its market share among exchanges supporting USD deposits has risen to 21.1% in July from 8.3% in August 2022. This growth is attributed to the enhancement of its offering, including the launch of Kraken Pro. Despite a general decline in trading volumes, Kraken's share of total volumes has hit an 18-month high.

Binance Labs Invests in Curve DAO Token

Binance Labs, the venture capital arm of Binance, has committed to investing $5 million in the Curve DAO Token (CRV), the token behind the Curve decentralized exchange (DEX) on the Ethereum blockchain. Curve is exploring a potential deployment on Binance's BNB Chain. Curve is a stableswap and DEX with about $2.4 billion in total value locked (TVL). Despite being hacked for over $70 million last month, Binance Labs has offered its full support to Curve through investment and strategic collaboration. The Curve DAO Token is used for exchanging stablecoins, staking, and governance. After the Binance investment was announced, CRV saw a 4.8% increase before settling back down.

Bitcoin ETF Momentum Slows Down

The momentum for a Bitcoin ETF has slowed down as the crypto market enters a summer slump. While some altcoins performed well, Bitcoin's price has been affected. Interest in NFTs and DeFi has also decreased, with negative news surrounding Azuki and a vulnerability in the Vyper programming language. However, crypto stocks, particularly mining companies, have shown strength and outperformed BTC. Coinbase and MicroStrategy shares saw significant gains. According to a Bloomberg ETF analyst, if spot Bitcoin ETFs are approved in the United States, the country could account for 99.5% of the global trading volume for crypto-related ETFs. Currently, North America already represents 97.7% of all crypto ETF trading volume. The Securities and Exchange Commission is currently reviewing several spot Bitcoin ETF applications.

Altcoin Season Predicted by Technical Analysis

The market cap of altcoins is forming a bullish inverse head-and-shoulders pattern, which could signal the beginning of an "alt season" where alternative cryptocurrencies outperform bitcoin and ether. Technical analysis by Josh Olszewicz suggests that the completion of this pattern would be confirmed if the market cap rises above the neckline resistance near $300 billion. Olszewicz is waiting for a break above this level to confirm the pattern and the potential onset of alt season.

Canadians Have 'Weak Incentives' to Use a CBDC

The Bank of Canada has released a paper stating that Canadians have little incentive to use a central bank-issued digital currency (CBDC). The paper explores a scenario where cash is virtually eliminated and examines the potential role of a CBDC in helping the underbanked. However, it found that most consumers would have weak incentives to use a CBDC, as Canadians already have access to financial services like bank accounts and credit cards. Replacing cash with digital currency would limit payment options for tech-averse Canadians and leave cash-dependent individuals unable to make common payments. Additionally, low uptake of a CBDC would discourage merchants from accepting it. The paper suggests alternative ways to assist the underbanked, such as improving internet access and expanding low-cost bank account availability. It emphasizes the importance of cash for offline payment methods in emergency situations. The Bank of Canada reaffirms its commitment to supplying cash and states that a CBDC would only be issued in a cashless society or with the widespread use of foreign CBDCs or cryptocurrencies.

Visa Explores Crypto Gas Fees Payments Through Cards

Visa is testing a solution that allows users to pay on-chain gas fees using a Visa card. The current process of acquiring and transferring ETH for gas fees can be complex and inefficient. Visa's solution involves using Ethereum's ERC-4337 standard and a "paymaster" smart contract to settle gas fees off-chain. Users trigger an Ethereum transaction via their wallet, which is sent to the paymaster. The web service computes the gas fee and charges Visa, and the wallet attaches a digital signature before sending it to Ethereum. This eliminates the need for users to hold ETH solely for paying fees. Visa has trialed this concept on the Ethereum Goerli testnet and it has the potential to reduce friction for blockchain users. It also opens up opportunities for merchants and dApps to facilitate gas fee payments using Visa cards.

As always, stay tuned for more updates in crypto!